There is a certain enthusiasm in liberty, that makes human nature rise above itself, in acts of bravery and heroism.

Alexander Hamilton, The Farmer Refuted

2000

The First Chapter of the Tech Revolution in Media

Cravath advises Time Warner in its merger with America Online to create AOL Time Warner, and Vivendi in its acquisition of Seagram and Canal Plus to create Vivendi Universal.

2000

Classic Consumer Brands Unite

The Firm handles Unilever’s unsolicited offer for Bestfoods, maker of Skippy peanut butter. A year later, Cravath guides the company in its acquisition of Ben & Jerry’s.

2000

The Bubble Bursts

At the end of the dot-com boom in the early 2000s, Cravath defends companies including Deloitte & Touche, Priceline.com, Tyco, Vivendi and Xerox as they are thrust into the wave of complex securities litigation arising from the fallout and begins its defense of Credit Suisse in the Enron litigation.

2000

Oil

The Firm represents Atlantic Richfield Company in its merger with BP Amoco, transforming BP into a global player. A year later, Cravath represents Conoco in its merger with Phillips Petroleum to create Conoco Phillips, America’s third-largest U.S. integrated oil company.

2004

Sprint, advised by Cravath, merges with Nextel, creating one of the largest companies in the cellular market.

2003

Internet Antitrust

Netscape, represented by Cravath, sues Microsoft and wins a $750 million settlement.

2002

Flying High

Cravath helps Alcoa defend its patent to the material used to manufacture the fuselage skin of the Boeing 777.

2005

Evolution of a Tech Icon

The Firm represents IBM in selling its global PC business to Lenovo, the largest U.S. acquisition by a Chinese company at the time. Ten years earlier, Cravath guided IBM in its hostile takeover of Lotus—at the time, the largest-ever acquisition of a software company.

2004

Governor’s Counsel

The Speaker of the State Assembly challenges the Governor of New York in his authority to exercise the line-item veto. The New York Court of Appeals holds that the Governor had the right not only to initially fix the amount of appropriations, but also how appropriations would be spent. Cravath represents the Governor of New York.

Evan Chesler

Litigator and Mentor

Evan Chesler has long been recognized as one of America’s preeminent litigators, successfully representing companies in their most complex cases across every level of the judicial system—all while training the next generation of Cravath litigators. He is known for his philanthropic devotion to the city in which he was born and raised, particularly his alma mater, New York University. After serving as Presiding Partner, Chesler was honored with the title of Chairman.

Evan Chesler

2005

Music Goes Digital

The Firm wins a pivotal ruling for the recording industry and its client, Warner Music Group, establishing that recording contracts entered into prior to the advent of the Internet give record labels the rights to digital distribution.

2006

Cravath advises on the take-private of TXU, the largest leveraged buyout in U.S. history, and handles the financing for the take-private

of Freescale Semiconductor, the largest tech LBO in history.

2008

The Right to Shelter for Homeless Families

The Legal Aid Society, helped by the Firm, achieves a landmark settlement providing a permanent and enforceable judgment regarding emergency shelter for homeless children and their families in New York City, resolving 25 years of litigation.

2008

Finding Stability

In the depths of the financial crisis, partner Timothy Massad takes leave from the Firm to serve as special legal advisor to the Congressional Oversight Panel created under the Emergency Economic Stabilization Act of 2008. He returns briefly to Cravath, but in 2009 he is called to serve in the U.S. Department of the Treasury as Chief Counsel for the Office of Financial Stability, which runs the Troubled Assets Relief Program. In 2014, he becomes Chairman of the Commodity Futures Trading Commission.

2008

Too Big To Fail

Cravath advises the boards of Morgan Stanley, Merrill Lynch, General Motors and Fannie Mae in navigating the global financial crisis. The Firm also defends Credit Suisse and JPMorgan in the wave of residential mortgage-backed securities litigation filed in state and federal courts across the country. In the midst of the crisis, Cravath advises JPMorgan in its multibillion-dollar financing for Mars to acquire Wrigley.

2008

Rebuilding British Banks

HM Treasury, the UK’s economic and finance ministry, devises a rescue plan involving the recapitalization of three of the UK’s largest banks. Cravath represents HM Treasury.

2009

Fashion-Forward

The Firm represents Lifetime in a contract and copyright dispute, securing its ability to telecast “Project Runway.” A year earlier, Cravath won summary judgment for Dooney & Bourke in a trademark infringement claim by Louis Vuitton.

2009

Bank of America acquires Merrill Lynch & Co. in a $52 billion all‑stock transaction. Cravath advises the independent directors of Merrill Lynch.

2009

Warren Buffett’s

Biggest Deals

Berkshire Hathaway acquires Burlington Northern Santa Fe Corporation, advised by Cravath, for $44 billion. Six years later, Precision Castparts, whose turbine airfoils and valves are used by both Airbus and Boeing, is acquired by Berkshire Hathaway, the largest acquisition in its history. Cravath advises Precision Castparts.

2010

Buying a National Treasure

Cravath advises Kraft Foods in its unsolicited bid for Cadbury, the 186-year-old British confectionary. The response in the UK results in a rewrite of its Takeover Code.

2010

United Airlines merges with Continental Airlines and creates the world’s largest airline. Cravath represents United.

Allen Parker

Allen Parker

Counselor and Executive

At Cravath, Allen Parker was known for his broad corporate law practice, and gained national renown for his acumen in banking law in particular. His reputation was such in the banking community that he went on to join Wells Fargo, a client the Firm has represented since the late 1800s, as General Counsel in 2017, after having served four years as Cravath’s fifteenth Presiding Partner.

2011

After retiring from the Firm, Patricia Geoghegan goes on to serve in the U.S. Treasury Department as the Troubled Asset Relief Program Special Master for Executive Compensation.

2013

Jeff Bezos

Buys The Washington Post

Jeff Bezos buys the newspaper publishing businesses, including The Washington Post, from The Washington Post Company. Cravath represents The Washington Post Company.

2014

Protecting the Rights of Children

Cravath wins a unanimous U.S. Supreme Court victory in an international custody dispute concerning the “now settled” defense to a child’s return under the Hague Convention. The decision concludes a nearly four-year battle to keep a child in the United States after she and her mother had fled the United Kingdom due to alleged domestic abuse by the child’s father.

2013

Cravath advises HM Treasury in the privatization of Lloyds of London.

2014

Fox Hunt

The Firm comes to the defense of Time Warner once again, rebuffing an unsolicited approach from 21st Century Fox.

2015

A Stichting

in Time

The Firm defends Mylan in thwarting a hostile takeover attempt from Teva Pharmaceutical Industries, employing a novel Dutch voting structure to protect the independence of a generics pioneer.

2015

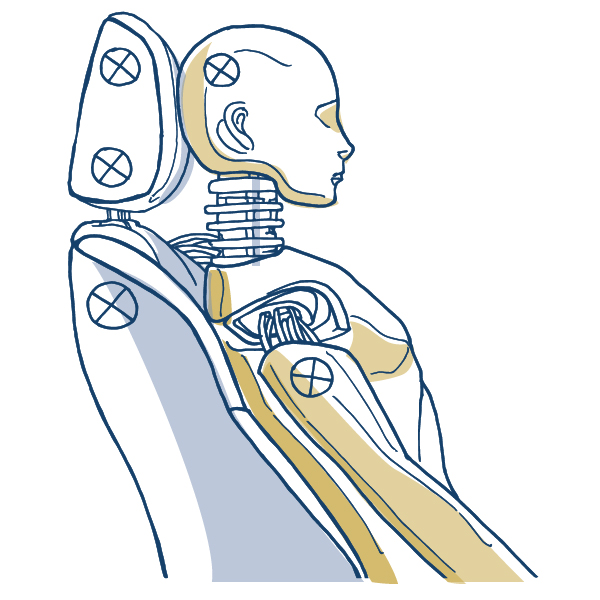

A Massive Recall

The National Highway Traffic Safety Administration appoints a Cravath monitor to oversee the recall of Takata airbags, the largest and most complex recall in U.S. history. Less than two years later, the U.S. Department of Justice calls upon Cravath to monitor compliance for the worldwide operations of Takata, which is headquartered in Japan.

2015

Ferrari Goes Public

The Firm advises the underwriters of the IPO of Ferrari, the legendary Italian sports car maker.

2016

A Toast to Global Dealmaking

The Firm takes public the Mexican tequila maker, Jose Cuervo, which was family-owned since the mid-18th century. Cravath also represents British American Tobacco, with whom the Firm’s relationship has spanned decades, in its acquisition of Reynolds American.

Faiza Saeed

Faiza Saeed

Dealmaker and Advisor

Faiza Saeed’s career as an M&A lawyer has included leading transformative deals in many industries and serving as a trusted advisor to both entrepreneurs and boards of directors. In 2016, she was elected Cravath’s sixteenth Presiding Partner.

2016

Suds

Creating the first truly global brewer, Cravath represents Anheuser-Busch InBev in its acquisition of SABMiller, its closest industry rival. Four years earlier, Cravath advised Grupo Modelo in its combination with ABI, one of the largest cross-border acquisitions of a Latin American company in history.

2017

Biotech Makes Its Mark

Cravath represents Amgen in a precedent-setting biologics case, bringing the first biosimilar of Humira® to market in the United States and Europe. The Firm also advises Johnson & Johnson, a client since the early 20th century, in its acquisition of Swiss biopharma company Actelion, the largest acquisition in Johnson & Johnson’s 130-year history. A year later, Cravath advises gene therapy pioneer AveXis in its acquisition by Novartis.

2017

In 2017, partner Rowan Wilson is confirmed as an Associate Judge of the New York State Court of Appeals, the State’s highest court.

2016

Argentina’s Return to International Markets

After defaulting on its sovereign debt, Argentina is unable to access global financing markets for 15 years. The Firm resolves the litigation with “holdout” bondholders and leads Argentina’s bond offering, the largest-ever emerging market debt issuance, marking the country’s return to global capital markets.

2017

Toward a More Perfect Union

Cravath files amicus briefs supporting plaintiffs in several cases that would impact the courts’ interpretation of Title VII and Title IX of the Civil Rights Act of 1964. Following the position Cravath advocates, the Seventh Circuit became the first federal appellate court in the country to extend the Act’s protections to discrimination on the basis of sexual orientation.

In a subsequent case in the Second Circuit, in which Cravath also files an amicus brief, 10 judges in the majority line up with the en banc Seventh Circuit decision, ruling that Title VII prohibits employment discrimination on the basis of sexual orientation.

2018

Insurance

AXA, advised by Cravath, acquires XL Group. The Firm’s relationship with AXA dates back to 1991 when Cravath advised it in obtaining control of Equitable Life through a complex demutualization coupled with an Equitable public offering.

2018

The Firm represents Pacific Gas and Electric in litigation arising from the 2017 and 2018 California wildfires.

2018

Another Precedent-Setting Antitrust Victory

After nearly a decade of litigation, Cravath secures a victory for American Express in the U.S. Supreme Court after the U.S. Department of Justice sued, alleging that American Express’s agreements with merchants violated antitrust law. The decision established new law on “two‑sided” markets and has implications for competition across industries—particularly for technology and internet companies.

2018

Bringing Relief

As special counsel to the Federal Emergency Management Agency and the Department of the Treasury, Cravath helps to structure, negotiate and litigate community disaster loans proposed for Puerto Rico and the U.S. Virgin Islands in response to Hurricane Maria, at a time when the Commonwealth of Puerto Rico and a number of its instrumentalities had filed for bankruptcy relief.

2018

The Next Revolution in Mobile Technology

Cravath represents Qualcomm, the pioneer in 5G, as both plaintiff and defendant in litigation against Apple related to the company’s patent licensing and modem chipset businesses.

2018

Global Trade on Blockchain

IBM and A.P. Moeller–Maersk create a joint venture to provide more efficient and secure methods for conducting global trade using blockchain technology. Cravath represents IBM.

2018

Media 3.0

Cravath advises Disney in its acquisition of 21st Century Fox, overcoming an interloper bid from Comcast; Time Warner in its sale to AT&T, which included defending the first fully litigated challenge to a vertical merger in 40 years; and Viacom’s special committee in discussions regarding a recombination with CBS.